More information

Second Home Insurance UK

Insuring a property that isn’t your main residence can be tricky. We can help!

Do I need second home insurance?

If you own a second home, you likely aren’t occupying it as often as your main residence. An unoccupied home is more vulnerable to risks such as theft, fire, and other hazards – which is why we recommend buildings and content insurance for second homes, to protect both your property and your belongings.

What counts as a second home?

A second home is a property that you don’t live in majority of the time, whereas a main residence is the home you occupy most of the time, store your main belongings in, and use for any legal, voting or banking purposes.

Home insurance for second homes is just as vital as the cover you put in place for your main residence. Whether you’re renting out your property, leaving it unoccupied for long periods of time, or using it for holiday getaways, our team is here to help identify the right second home insurance policy for you based on your situation and needs.

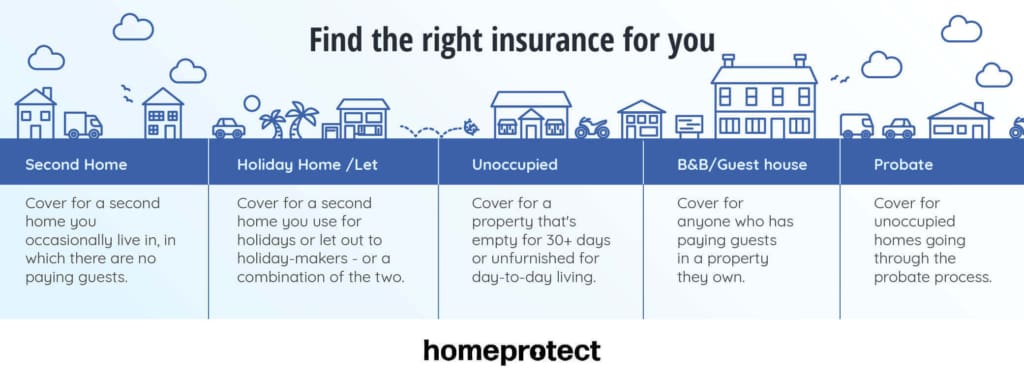

What type of second home insurance do I need?

The type of insurance and policy terms you need will depend on the type of property you’re trying to insurance. Examples of types of second homes you may want to insure include:

Second home insurance for holiday homes:

You can get second home insurance for holiday homes, such as a property that is being used seasonally or is being rented to paying guests.

The way you use your holiday home will determine what price and policy terms we can offer. Policy terms are determined once we consider the risks associated with your property. For example, if you rent out your holiday home, damage could be caused by paying guests during their stay. Other details are considered as well, including location, rebuild value, property security, and property maintenance.

We can cover a range of holiday home types such as cottages, mansions, lodges, country homes, and barn conversions.

Second home insurance or unoccupied homes:

If your second home is one you don’t usually live in, and is being left unoccupied for more than 30 consecutive days, we suggest you get it covered.

You must let Homeprotect know if your property will be vacant for over 30 consecutive days so that we can factor increased risks into your policy terms, or else you might run the risk of any claim being rejected due to an invalid home insurance policy.

You can read more about why unoccupied homes are riskier in our guide.

Second home insurance for landlords:

Landlords who are renting out their second property will need insurance coverage due to the increased risks that come from tenant relationships and the fact that they aren’t present in the property every day.

Our landlord home insurance includes loss of rent cover, in the event of an insured loss, and comes with the option for additional extras including landlord legal protection, to give property owners peace of mind when renting to tenants.

If you let us know your property is let out to tenants, we can tailor your policy accordingly.

specialist Home Insurance Reviews

Get a home insurance quote online

Get a quote online in less than 10 minutes*

What’s covered by SECOND HOME insurance?

Home insurance provides financial protection if you need to repair your home or replace your belongings after they’ve been stolen, damaged or destroyed.

It comes in two parts: buildings insurance (cover against damage to the property itself) and contents insurance (for damaged or stolen items within the home). These can be combined or bought separately, so the first step is deciding which option is better for you.

What we offer

Quick home emergency response times

Have a home emergency, such as electricity failure, faulty locks or vermin infestation? With the 24/7 Home Emergency cover, which we provide as standard, you can typically get an engineer at your home within four hours. And if you’re worried about an uncontrollable leak in your home, we aim to have an emergency plumber to you within two hours.

Extreme weather conditions may extend response time. Policy terms and claim limits apply.

5 star rated buildings cover

Our building insurance has been given the highest rating by independent financial research companies, Defaqto and Moneyfacts.

Repair guarantee

Any buildings work we undertake is guaranteed for 24 months following a claim and any contents repair work we undertake is guaranteed for 12 months.

New for old

Where we replace an item, we will do our best to meet the original specification on a ‘new for old’ basis. If we can’t find an exact replacement, we’ll offer you a suitable alternative, or a full cash settlement.

Legal advice

We provide Legal Protection cover as standard, giving you access to telephone legal advice on any personal legal issue, under the laws of the UK, any European Union country, the Isle of Man, Channel Islands, Switzerland and Norway.

What isn’t included?

Damage caused gradually, or by wear and tear, or by failure to fix a known issue.

Faulty design or poor workmanship.

Theft, vandalism or accidental damage caused by a paying guest.

Escape of water incidents occurring between 1 October – 1 April (inclusive) if your home is left unoccupied for more than 30 consecutive days.

The cost of repairing or replacing items following a mechanical or electrical fault.

Lost items.

SECOND HOME Insurance Cover Levels

Our home insurance is designed to protect your home against insured events such as fire, storm, flood, escape of water, theft, malicious damage, subsidence, landslip or heave.

Buildings cover

Covers the main structure of your home if you need to rebuild or repair it.

up to £1 million

(eligibility criteria applies)

Contents cover

Covering the value of all your possessions in the home, on a new for old basis.

from £25,000

Loss of rent

If you have paying guests, we’ll cover lost rent if your guests can’t stay in the home due to an insured event.

up to £30,000

Home emergency

Covers emergencies that occur in your home like uncontrollable water leaks, electricity failure, faulty locks and vermin infestation. Two levels of cover are available.

up to £500

Family legal protection

Provides a 24/7 legal advice helpline and up to £25,000 cover for claims involving contract disputes and property damage. For a claim to be successful, there must be reasonable prospects (more than a 50% chance) of winning the legal case. Two levels of cover are available.

up to £25,000

Trace and access

Covers the cost of detecting the source of a water or oil leak and repairing any damage caused in the process.

up to £10,000

Outbuildings cover

Covers rebuild or repair of your outbuildings (such as detached garages, greenhouses, sheds and summerhouses).

from £20,000

Liability cover

Liability cover involving accidental death, bodily injury or illness or property damage that you are legally liable to pay.

up to £5 million

Personal possessions

Cover for portable items that you take out of your home, like bags, clothes and sports equipment

Optional

(excluded if you have paying guests)

Gadgets, bikes and valuables away from the home

Cover for electronic gadgets (e.g. mobile phones, laptops, tablets etc), bikes (including electrically assisted bikes) and valuables (e.g. watches and jewellery) that you take out of your home.

Optional

(excluded if you have paying guests)

Accidental damage

Covers situations when unexpected accidents happen, such as spillages on the carpet, breakages around the house or drilling through hidden pipes. Two levels of cover are available.

Optional

(excluded if you have paying guests)

New Customer?

If you’re deciding on whether to buy home insurance with us, you can use our latest policy booklets as a guide.

Existing Customer?

Find answers to some of your questions here. Your latest policy documents are also available to view and download.

You might also be interested in…

Stamp Duty on second homes

Looking to buy a home and need help calculating how much Stamp Duty you’ll need to pay? Use our helpful Stamp Duty calculator below:

Stamp Duty you will pay:

Before 31st March 2025

The effective tax rate is 0%.

After 31st March 2025

The effective tax rate is 0%.

Calculate how much Stamp Duty you will pay

This stamp duty calculator provides an indicator of the tax due if you buy a residential property. You should always use a property professional for complex transactions.

Our stamp duty figures only apply to England & Northern Ireland. Scotland & Wales have different rules. Our assumptions are:

- You are buying a property with fixed foundations (e.g. not a caravan, mobile home or houseboat).

- There aren’t multiple properties in the transaction.

- The purchase will be made by an individual, married couple or civil partners not by an organisation, or group of unpartnered people.

- That this is not new leasehold property with a large annual rent e.g £4,500 a year for a 99 year lease.

Your Questions Answered

Yes, if you own more than one residence, Homeprotect can help insure both of your properties. Each property will need its own insurance policy, as each home is different, and the type of cover needed for your second home will be different than for your main residence. Depending on your situation, Homeprotect provides second home insurance for rental properties, second home insurance for holiday homes, and second home insurance for homes left unoccupied.

Just like when you research insurance for your main residence, to get a quote for second home insurance you will need to know the rebuild cost of your second property. This is the amount it would take to build from scratch, not your home’s market value. You should also know the year the property was built, the property’s history including subsidence and flooding, and the value of your belongings to be insured.

Most mortgage lenders insist that homeowners have adequate second home buildings insurance in place. It is also generally recommended that you have contents insurance to protect your belongings. In the event of a loss or damage, contents insurance can help to cover the cost of repair or replacement. This is a worthwhile investment if you are letting your second home to paying guests.

You’ll need to be able to prove that you have an insurable interest in the property for cover to be provided. Get in touch with our team to discuss your situation and learn what your options are.

Defining which property is your main residence can sometimes be tricky. Aspects to consider when making the decision are where most of your belongings are kept and where you spend the majority of your time.

For instance, if one address is predominantly used for legal interests, is where your car is registered and is what you would consider to be the family home then your insurer will use this distinction to provide cover for your main residence. Anything outside of these situations would typically be a second home, including holiday homes and weekday/weekend properties.

The price of second home insurance will vary depending on your situation and what kind of coverage you need.

Homeprotect must be made aware if your property will be left empty for more than 30 days. An unoccupied home is susceptible to more risks such as burglary. Get in touch with us to learn more about empty home insurance for your second property.

Prefer to SPEAK WITH us?

Our insurance experts are on hand if you have any questions.